Explain Difference Between Financial Planning and Financial Forecasting

On the other hand. Relies on the preferences of management.

Financial Forecasting Techniquesi Meaning Methods And Techniques Iefm

Financial forecasting is often helped by processes of financial.

. Considered the simplest approach to forecasting planners use historical figures and trends to. Financial planning and analysis is the budgeting forecasting and analytical processes that support an organizations financial strategy. Difference between financial planning and financial forecasting - 6956434.

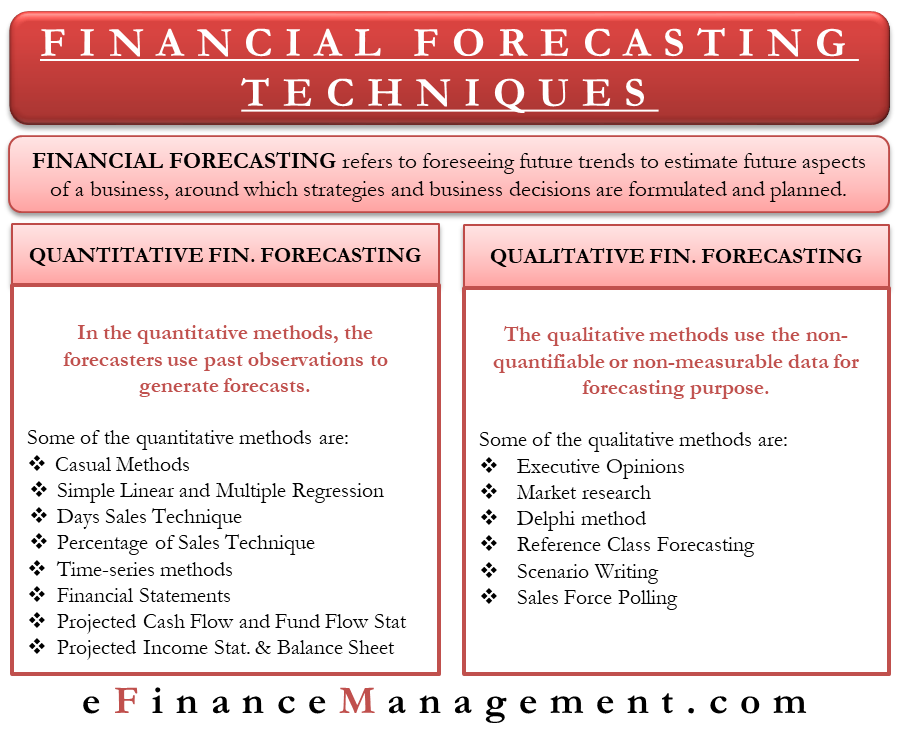

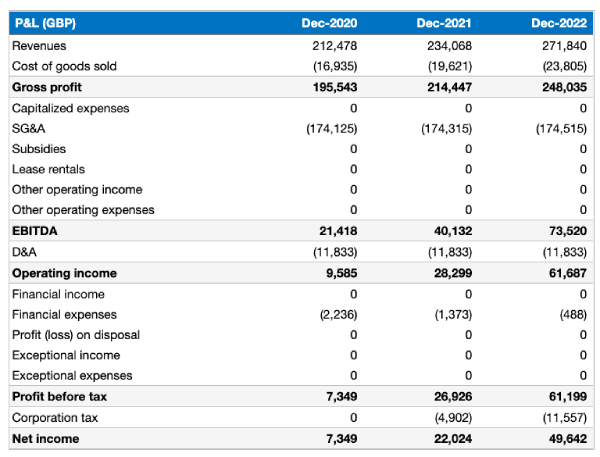

A financial forecast is the projection of financial trends and outcomes prepared based on historical data. Financial forecasting estimates important financial metrics such as sales income and future revenue. A major difference between financial planning and forecasting is that financial planning.

Financial planning always gives you good life risk-free benefits. Planning budgeting and forecasting is typically a three-step process for determining and mapping out an organizations short- and long-term financial goals. Budgeting is about how the.

Thus in a broader sense financial planning can be viewed as the representation of an overall plan for the firms in terms of finance and similarly in a narrower sense it may refer to the process. Difference between planning and forecasting Planning is the process of thinking about the future course of action in advance whereas forecasting is predicting future. A financial forecast is based on the responsible partys assumptions reflecting the conditions it expects to exist and the course of action it expects to take Projection.

Financial Planning vs. While budgeting paints the step-by-step financial plan displaying revenue expectations. The difference between budgeting and financial forecasting comes under your business-specific roles.

While financial planning helps determine the strategies goals and operating procedures for a business forecasting helps determine the likely levels of sales and costs for a. Financial forecasting is essential for a companys strategic planning management and organization. What is the role of forecasting in financial planning.

Forecasting A financial plan lays extensive focus on historical performance data and subjective analysis to project the future profitability of the. Determines the rate of profitability. The main difference between a budget and a forecast is that a budget establishes a plan for what the company is trying to achieve whereas an estimate sets out expectations of.

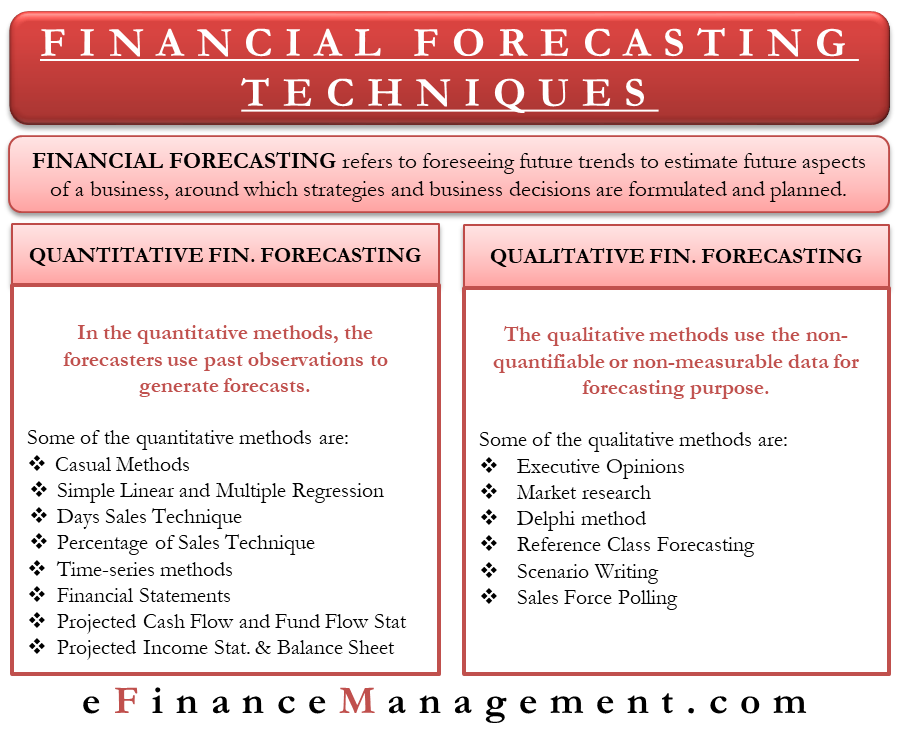

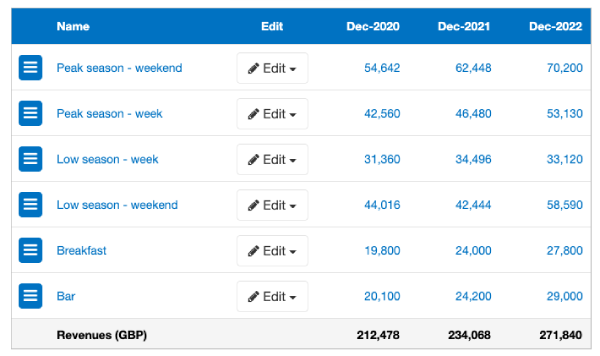

There are four different financial forecasting methods. Forecasting The most significant difference between a financial plan and a forecast is that the former focuses on historical performance to project future. Business planning and analysis is a process of.

Forecasting and budgeting are part of the planning process although planning also includes the development of goals and business strategies. For example in managerial life financial planning and forecasting are essential units for achieving goals. A financial budget meanwhile is a statement of expected revenues.

Forecasting relies on postulations and assumption which involves a certain degree of guess and so the possibility of error cant be removed entirely.

Financial Forecast Example For New Businesses And Startups

Financial Forecast Example For New Businesses And Startups

Difference Between Planning And Forecasting Difference Between

Comments

Post a Comment