Return on Common Equity Formula

Net income for the year is 45000. Assets turnover ratio calculator.

Return On Common Stockholders Equity Roce Formula Example

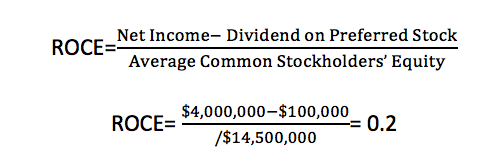

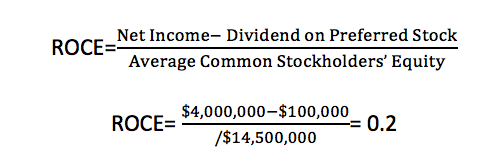

Return on common stockholders equity can be calculated by dividing the companys net income after preferred dividends net income preferred dividends by the total common stockholders equity total stockholders equity preferred stockholders equity or the following return on common stockholders equity formula.

. Its return on common equity ratio is. Return on common equity ratio 224000 1124000 100 1993 Profit to equity shareholders Net profit after tax Dividend on preference shares 240000 16000 224000 Equity of ordinary shareholders Total assets Total liabilities Preference shares 2400000 1076000 200000. 100000 Shareholders Equity of current year Rs.

Then wed take the average shareholders equity for the period 8 billion 9 billion 12 billion 11 billion 40 billion divided by four quarters 10 billion. The return on equity formula is as follows. You can download this Return On Average Equity Template here Return On Average Equity Template Net Income for the year Rs.

ROE is determined using the following equation. RETURN ON EQUITY CALCULATION OF COLGATE Below are the balance sheet details of Colgate from 2008 to 2015. ROE is especially used for comparing the performance of companies in the same industry.

Average shareholders equity 135000 165000 2 150000. Learn How Our Equities Can Help Your Clients Pursue Their Investment Goals. Return on common stockholders equity ratio shows how many dollars of net income have been earned for.

The formula ROE Net Income Equity ROE is equal to a fiscal year net income after preferred stock dividends before common stock dividends divided by total equity excluding preferred shares expressed as a percentage. ROCE Net Income NI Average Common Shareholders Equity In order to find the average common equity combine the beginning common stock for the year on. As with return on capital a ROE is a measure.

Accounts payable turnover ratio calculator. Determine net income Net income is an organizations total revenue minus its. ROE text Net Income div text Shareholders Equity ROE Net Income Shareholders Equity Regarding this equation net income is comprised.

To calculate the return on common equity use the following formula. The ROE arrived after applying the formula are given as under. ROE provides a simple measure to understand the investment returns of a company.

ROCE Net income preferred dividends average common equity x 100 850000 200000 2225000 x 100 292. Compared to the industry average of 224 the company ABC is a safe bet for investing. Dividing 63 billion income by 93 billion equity yields a rate of return on equity of 68.

The formula of Return on Equity is stated below Return on Equity Formula Net Income Total Equity Consider the following example of 2 companies having the same net income but different shareholder equity components. ROE of ABC Ltd Net Income Shareholders Equity. Accounting ratios calculators One Comment on Return on common stockholders equity ratio calculator.

That percentage means that Home Depot generated 068 of profit for every 1 that management had. Using the ratio of ROAE we get ROAE Formula Net Income Average Shareholders Equity 45000 150000 30. Equity share of rs 100 each rs 200000.

ROE Net income shareholders equity These steps and information can help you determine the ROE for any organization. That leaves us with 1. Anastasia finds out that for each dollar invested the company ABC returns 292 of its net income to the common stockholders.

0246 or 25 approx ABC Ltds Return on Equity is at 25. Finally the formula for an annualized rate of return can be derived by dividing the sum of initial investment value step 1 and the periodic gains or losses step 2 by its initial value which is then raised to the reciprocal of the holding period step. By following the formula the return that XYZs management earned on shareholder equity was 1047.

Has 20000 in earnings after taxes and 25000 in common equity shares. Return on common equity is calculated using information from the income statement and the balance sheet. Ad Equities Backed By The Capital System Ongoing Rigorous Investment Analysis.

This means that for every rupee invested in ABC Ltd its investors would earn 025 rupees. 200000 Lets first calculate Average Shareholders Equity. 20000 25000 x 100 80 This is an extremely high return for the quarter.

In the example below ABC Co. Net profits - Dividends on preferred stock Equity - Preferred stock Return on common equity This calculation is designed to strip away the effects of preferred stock from both the numerator and denominator leaving only the residual effects of net income and common equity. 25000 Shareholders Equity of previous year Rs.

2550000 2400000 2 800000 800000 2 2475000 800000 1675000 Significance and Interpretation. Return on common equity. Average collection period calculator.

The return on common equity is calculated as follows.

Rate Of Return On Common Stockholder S Equity Roe Youtube

Return On Common Equity Definition And Example Corporate Finance Institute

Comments

Post a Comment